Michael Gable, Fairmont Equities

BUY RECOMMENDATIONS

BUY – Mineral Resources (MIN)

Weaker iron ore and lithium prices contributed to the share price falling from $96.28 on January 24 to trade at $68.48 on June 8. Recently, lithium and iron ore prices appear to be finding support. The share price of this diversified resources company is also bottoming on the chart. MIN is potentially a good entry point around recent levels.

BUY – Lynas Rare Earths (LYC)

LYC shares were recently oversold on the back of concerns that production would be impacted when LYC switched to its new processing plant in Kalgoorlie. With an extension granted to its Malaysian plant, LYC won’t lose any production time. Combined with improving sentiment in the resources space, we expect the stock to attract more buyers at recent prices.

HOLD RECOMMENDATIONS

HOLD – BHP Group (BHP)

The global miner was recently sold down in response to softer iron ore prices and bearish sentiment towards the Chinese economy. We expect iron ore prices to rise and the Chinese economy to start improving. Consequently, we expect the share price to recover towards recent highs.

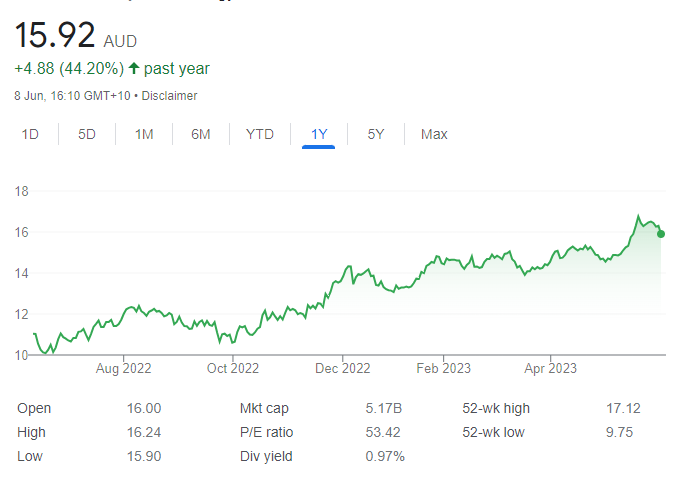

HOLD – Sandfire Resources (SFR)

Copper prices recently eased back, and bearish sentiment towards the Chinese economy impacted SFR’s share price. We believe these two factors will reverse to the benefit of Sandfire. We like the company’s outlook. The shares have staged a modest recovery after rising from $5.49 on May 26 to trade at $5.71 on June 8.

SELL RECOMMENDATIONS

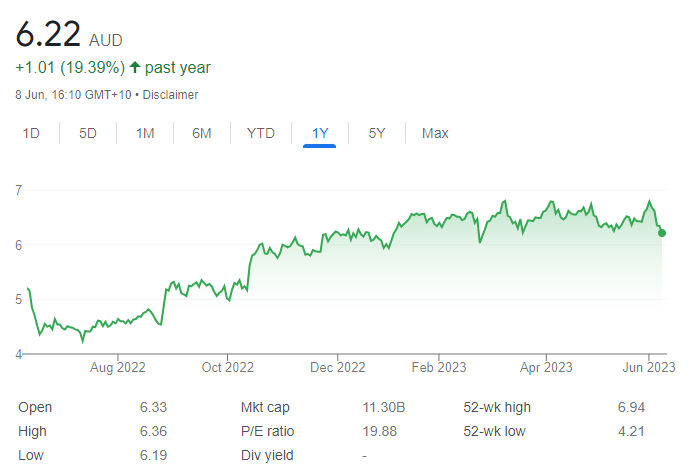

SELL – Bank of Queensland (BOQ)

A BOQ update revealed it had entered into a voluntary enforceable undertaking with the Australian Prudential Regulation Authority (APRA) to address the remediation of weaknesses in BOQ’s risk management practices, controls, systems, governance and risk culture. Also, BOQ has entered into a voluntary enforceable undertaking with AUSTRAC to address the remediation of issues in respect of BOQ’s anti-money laundering and counter-terrorism financing program. The shares have been trending down since the start of February.

SELL – Pact Group Holdings (PGH)

This packaging company faces challenges, including softer demand and higher costs. The company recently downgraded underlying earnings before interest and tax for the 2023 financial year. The share price has fallen from $1.39 on March 7 to trade at 64 cents on June 8. Other stocks appeal more at this stage of the cycle.

Top Australian Brokers

Tim Haselum, Catapult Wealth

BUY RECOMMENDATIONS

BUY – CSL (CSL)

This global biotechnology company delivered total revenue of $US7.184 billion at reported currency for the half year ending December 31, 2022. It represented an increase of 19 per cent on the prior corresponding period. Reported net profit from ordinary activities after tax fell 8 per cent to $US1.623 billion. CSL generates revenue from blood products, vaccines and kidney disease. CSL has a defensive earnings profile regardless of recession fears.

BUY – Goodman Group (GMG)

Goodman is an integrated property group. It enjoys high occupancy rates across industrial and warehouse assets. It has $13 billion of development work in progress across 79 projects. Guidance for operating earnings per security growth has increased to 15 per cent in fiscal year 2023. We expect growth, but modest dividends.

HOLD RECOMMENDATIONS

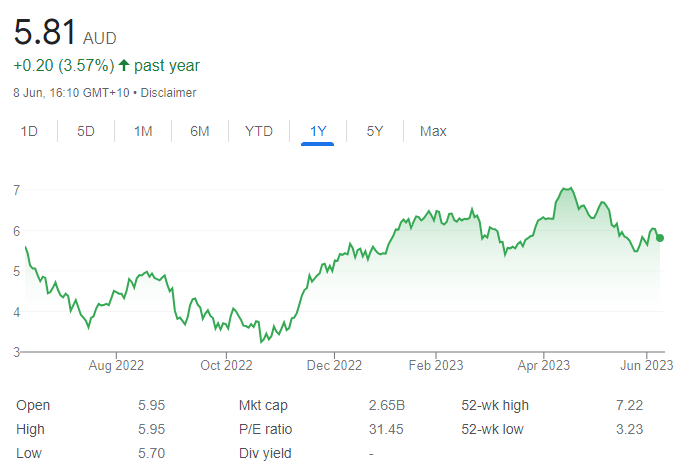

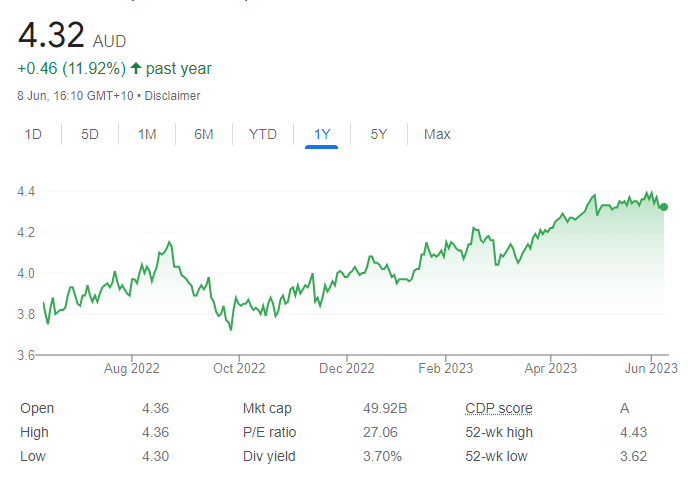

HOLD – Telstra Group (TLS)

The shares have risen from $3.76 on September 26, 2022 to finish at $4.32 on June 8, 2023. Strong reporting and a defensive dividend yield supported the rally. The company delivered a 6.4 per cent increase in total income to $11.6 billion in the first half of fiscal year 2023. We retain a hold recommendation on valuation grounds.

HOLD – Elders (ELD)

The share price of this Australian agribusiness has fallen from $13.25 on November 11, 2022 to close at $6.40 on June 8, 2023. Statutory net profit after tax of $48.8 million in the first half of fiscal year 2023 was down 47 per cent on the prior corresponding period. However, sales revenue of $1.657 billion was up 9 per cent. Conditions in this cyclical industry may get tougher before they get better, so we believe it may be too early to buy the share price dips at this point.

SELL RECOMMENDATIONS

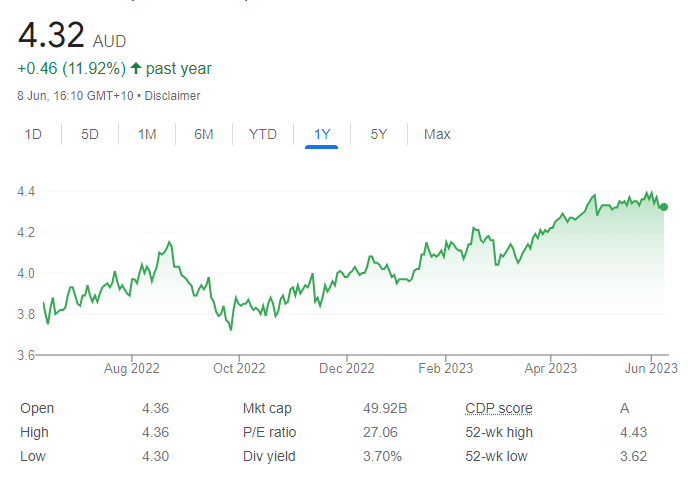

SELL – TechnologyOne (TNE)

TNE is a software-as-a-service provider, with offices across six countries. It has a good track record of delivering revenue, earnings and dividend growth. The company delivered a profit after tax of $41.3 million in the first half of fiscal year 2023, up 24 per cent on the prior corresponding period. The share price has performed strongly. We believe it may be time to consider trimming holdings on valuation grounds.

SELL – Northern Star Resources (NST)

We like this quality gold miner. The gold price may rise when interest rates peak and on potentially more market volatility. The shares have risen from $6.81 on July 1, 2022 to close at $13.14 on June 8, 2023. In our view, the company’s valuation looks stretched, so investors may want to consider cashing in some gains, or switching to a pure gold exchange traded fund.

John Athanasiou, Red Leaf Securities

BUY RECOMMENDATIONS

BUY – Mad Paws Holdings (MPA)

Mad Paws is an Australian based pet services and products business. Group operating revenues of $6.1 million for the quarter ending March 31, 2023 were up 189 per cent on the prior corresponding period and up 53 per cent on a pro-forma basis. We’re encouraged by the performance of US-based pet related stocks. MPA can be volatile, but we believe it’s trading at a discount.

BUY – Dateline Resources (DTR)

The company owns the Gold Links and Green Mountain projects in the US state of Colorado. It also owns the Colosseum gold mine in California. The Colosseum deposit contains mineral resources of 20.9 million tonnes at 1.2 grams a tonne of gold for 813,000 ounces of gold. Colosseum is known to host rare earths mineralisation. We expect DTR to attract more investor attention given the location and potential of their projects. DTR is a highly speculative stock. The shares were trading at 2.2 cents on June 8.

HOLD RECOMMENDATIONS

HOLD – Qantas Airways (QAN)

The airline is experiencing strong travel demand and flying activity has increased. The company is forecasting underlying profit before tax of between $2.425 billion and $2.475 billion for fiscal year 2023. The company is a strong performer. However, future travel demand is possibly factored into the share price at this point.

HOLD – Telstra Group (TLS)

This pure play defensive stock has performed well while the broader market has been crunched. The telecommunications giant attracts more interest than usual in turbulent times. Diversified revenue streams are appealing. Investors can hold for possible capital growth and reliable dividends.

SELL RECOMMENDATIONS

SELL – Pilbara Minerals (PLS)

The company produced 148,131 dry metric tonnes of spodumene concentrate in the March quarter, down 9 per cent on the previous quarter. The average estimated realised spodumene concentrate sales price was down 15 per cent on the December quarter. The share price has doubled in the past year to June 8, 2023, so investors may want to consider taking a profit.

SELL – Paladin Energy (PDN)

Paladin owns 75 per cent of the Langer Heinrich uranium mine in Namibia. It’s progressing towards commercial production in calendar year 2024. The shares recovered after the Namibian Government clarified it had no intention of seizing any stake from existing mineral or petroleum licence holders and remain committed to upholding the sanctity of the contract. We prefer other stocks.

The above recommendations are general advice and don’t take into account any individual’s objectives, financial situation or needs. Investors are advised to seek their own professional advice before investing. Please note that TheBull.com.au simply publishes broker recommendations on this page. The publication of these recommendations does not in any way constitute a recommendation on the part of TheBull.com.au. You should seek professional advice before making any investment decisions.