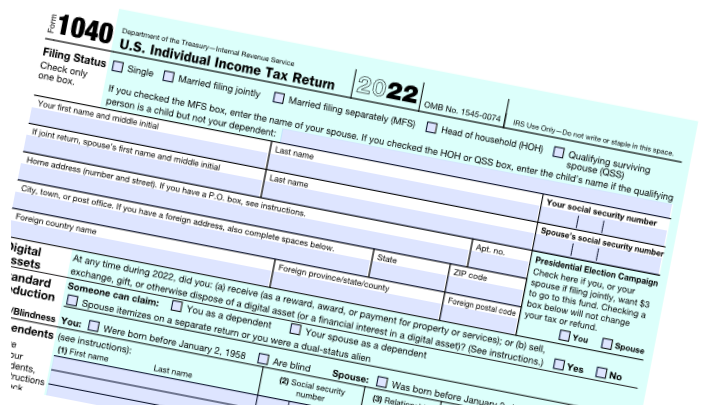

If you missed the tax deadline, it isn’t the end of the world, and IRS agents aren’t going to knock on your door anytime soon. The Internal Revenue Service says taxpayers who missed the April 18 tax-filing deadline should file as soon as possible.

Taxpayers who owe and missed the deadline without requesting an extension should file quickly to limit penalties and interest. For struggling taxpayers unable to pay their tax bill, the IRS has several options available to help.

The IRS also notes that taxpayers who are owed a refund won’t be penalized or fined for filing late, but people shouldn’t overlook filing a tax return when they are due a refund… unless you really want to basically donate that money (your money) to the IRS. Unfortunately, every year, more than 1 million taxpayers who are owed a tax refund, forget to file.

For 2022 tax returns that were due by April 18, 2023, some taxpayers automatically qualify for extra time to file and pay taxes due without penalties and interest, including:

Don’t overlook filing; people may miss out on a tax refund

Taxpayers who choose not to file a return because they don’t earn enough to meet the filing requirement may miss out on receiving a refund due to potential refundable tax credits. The most common examples of these refundable credits are the Earned Income Tax Credit and Child Tax Credit. Taxpayers often fail to file a tax return and claim a refund for these credits and others for which they may be eligible.

There’s no penalty for filing after the April 18 deadline if a refund is due. Taxpayers are encouraged to use electronic filing options including IRS Free File which is available on IRS.gov through Oct.16 to prepare and file 2022 tax returns electronically.

Taxpayers can track their refund using the Where’s My Refund? tool on IRS.gov, IRS2Go or by calling the automated refund hotline at 800-829-1954. Taxpayers need the primary Social Security number on the tax return, the filing status and the expected refund amount. The refund status information updates once daily, usually overnight, so there’s no need to check more frequently.

File and pay what you can to reduce penalties and interest

Taxpayers should file their tax return and pay any taxes they owe as soon as possible to reduce penalties and interest. An extension to file is not an extension to pay. An extension to file provides an additional six months with a new filing deadline of Oct. 16. Penalties and interest apply to taxes owed after April 18 and interest is charged on tax and penalties until the balance is paid in full.

Filing and paying as much as possible is key because the late-filing penalty and late-payment penalty add up quickly.

Even if a taxpayer can’t afford to immediately pay the full amount of taxes owed, they should still file a tax return to reduce possible late-filing penalties. The IRS offers a variety of options for taxpayers who owe the IRS but cannot afford to pay. For more information see the penalties page on IRS.gov.

Taxpayers may qualify for penalty relief if they have filed and paid timely for the past three years and meet other important requirements, including paying or arranging to pay any tax due. For more information, see the first-time penalty abatement page on IRS.gov.

Pay taxes due electronically

Those who owe taxes can pay quickly and securely via their IRS Online Account, IRS Direct Pay, debit or credit card or digital wallet, or they can apply online for a payment plan (including an installment agreement).

Taxpayers paying electronically receive immediate confirmation when they submit their payment. With Direct Pay and the Electronic Federal Tax Payment System (EFTPS), taxpayers can receive email notifications about their payments. For more payment options, visit IRS.gov/payments.

Selecting a tax professional

The IRS offers tips to help taxpayers choose a tax professional to help with tax return preparation. The Directory of Federal Tax Return Preparers with Credentials and Select Qualifications can help taxpayers find tax return preparers who hold a professional credential recognized by the IRS or who have completed IRS requirements for the Annual Filing Season Program.

Taxpayer Bill of Rights

Taxpayers have fundamental rights under the law that protect them when they interact with the IRS. The Taxpayer Bill of Rights presents these rights in 10 categories. IRS Publication 1, Your Rights as a TaxpayerPDF, highlights these rights and the agency’s obligation to protect them.