How to File Taxes for the First Time: A Step-by-Step Guide

Filing taxes for the first time can feel overwhelming, but it doesn’t have to be. Whether you’re a student, freelancer, or first-time employee, follow these simple steps to file your taxes accurately and on time.

1. Determine If You Need to File Taxes

You must file a tax return if: ✅ You earned more than $13,850 (single) or $27,700 (married filing jointly).

✅ You had self-employment income over $400.

✅ You received unemployment benefits or investment income.

🔗 Learn more: What Documents Do You Need to File Taxes?

2. Gather Your Tax Documents

Before you start filing, make sure you have: ✅ W-2 Forms (from employers).

✅ 1099 Forms (freelancers, side gigs, or investment income).

✅ Education expenses (Form 1098-T) if claiming education tax credits.

✅ Bank statements for deductible expenses.

🔗 Need a full checklist? What Documents Do You Need to File?

3. Choose How You Will File

✅ IRS Free File (if income is under $73,000).

✅ Tax software like TurboTax, H&R Block, or FreeTaxUSA.

✅ In-person help (VITA program or paid tax preparer).

🔗 Compare options: Best Free & Affordable Tax Filing Options

4. Claim Any Tax Credits or Deductions

Maximize your refund by claiming: ✅ Child Tax Credit (CTC) – Up to $2,000 per child.

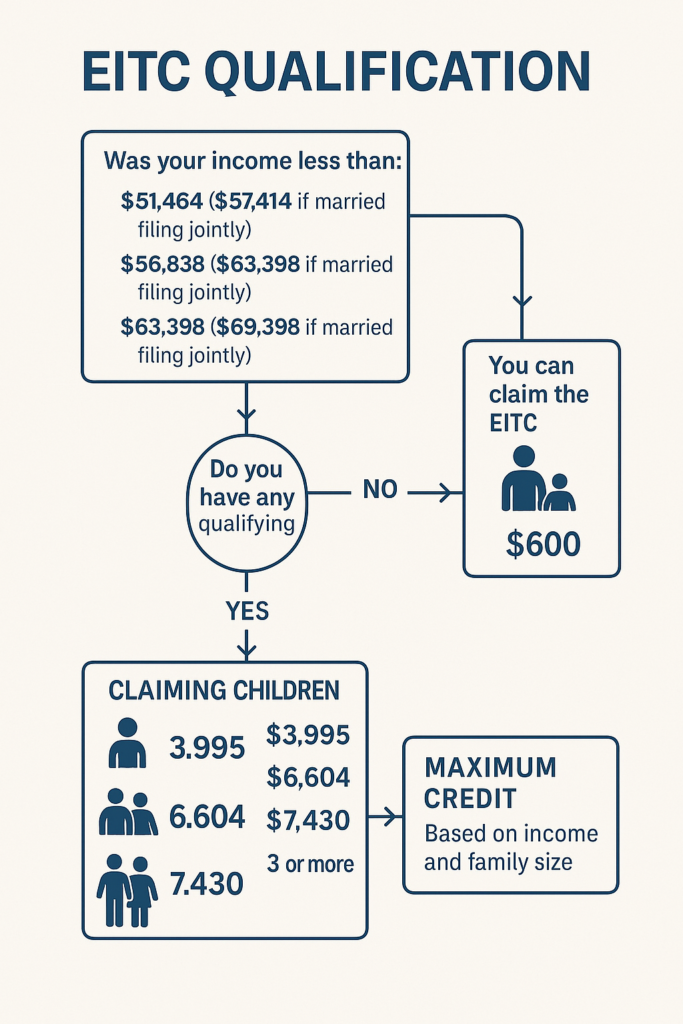

✅ Earned Income Tax Credit (EITC) – For low-to-moderate income workers.

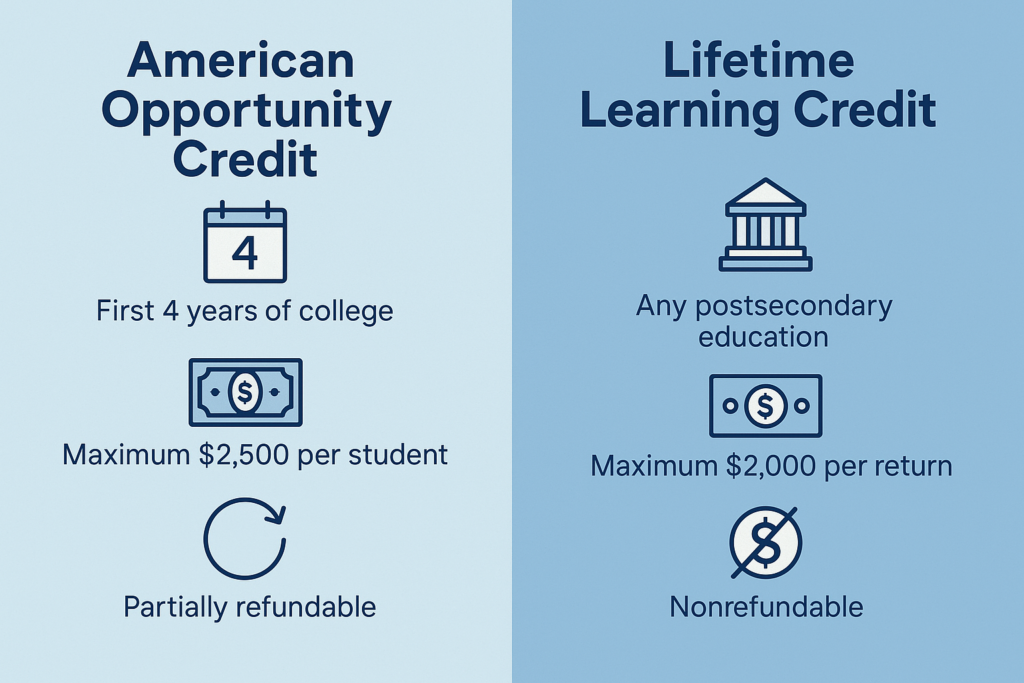

✅ Education Tax Credits – If you paid college tuition.

🔗 Related: Your Guide to Tax Credits & Deductions

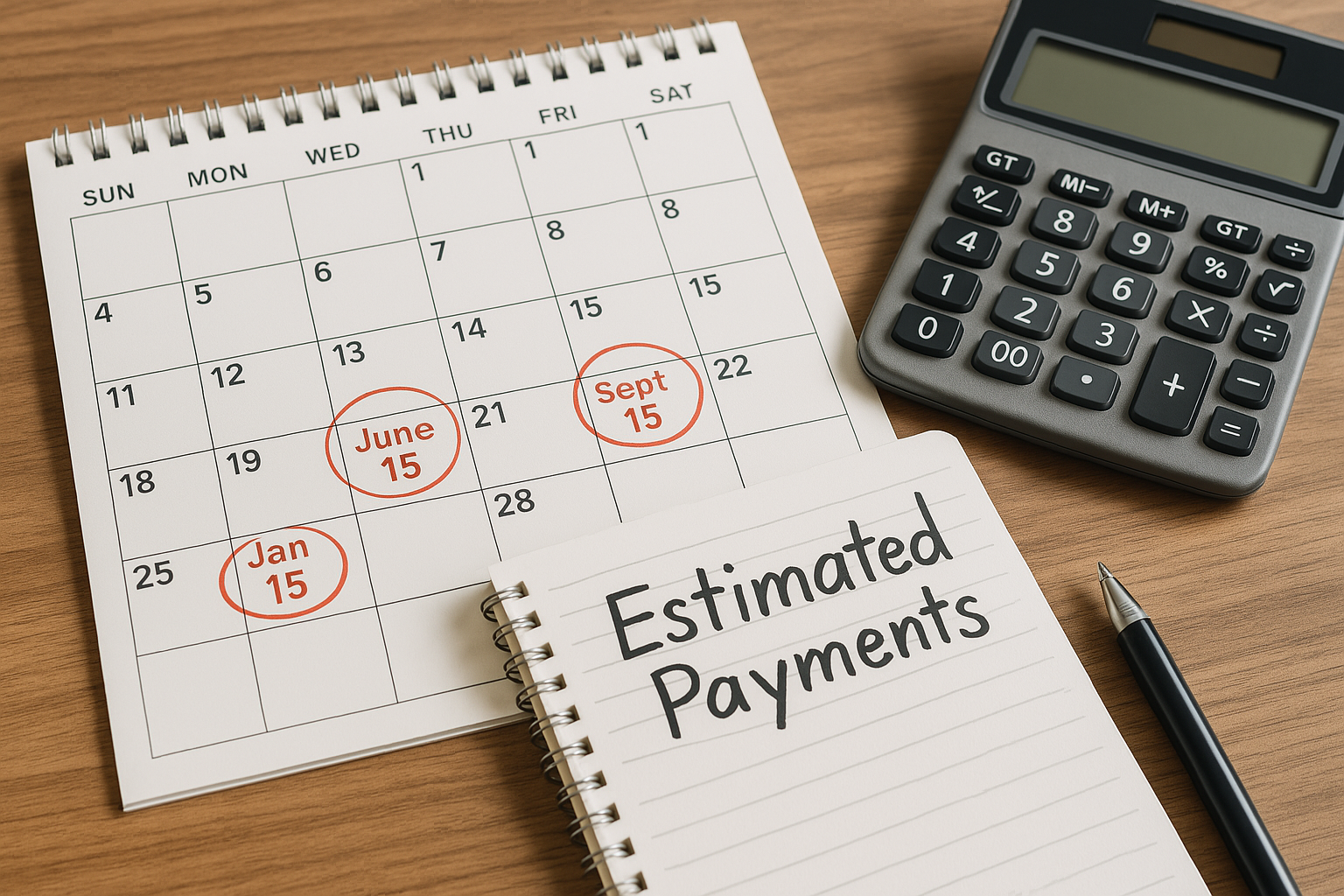

5. File Before the Tax Deadline

🚨 Tax Day 2025: April 15, 2025

✅ Filing late? Request an extension using Form 4868.

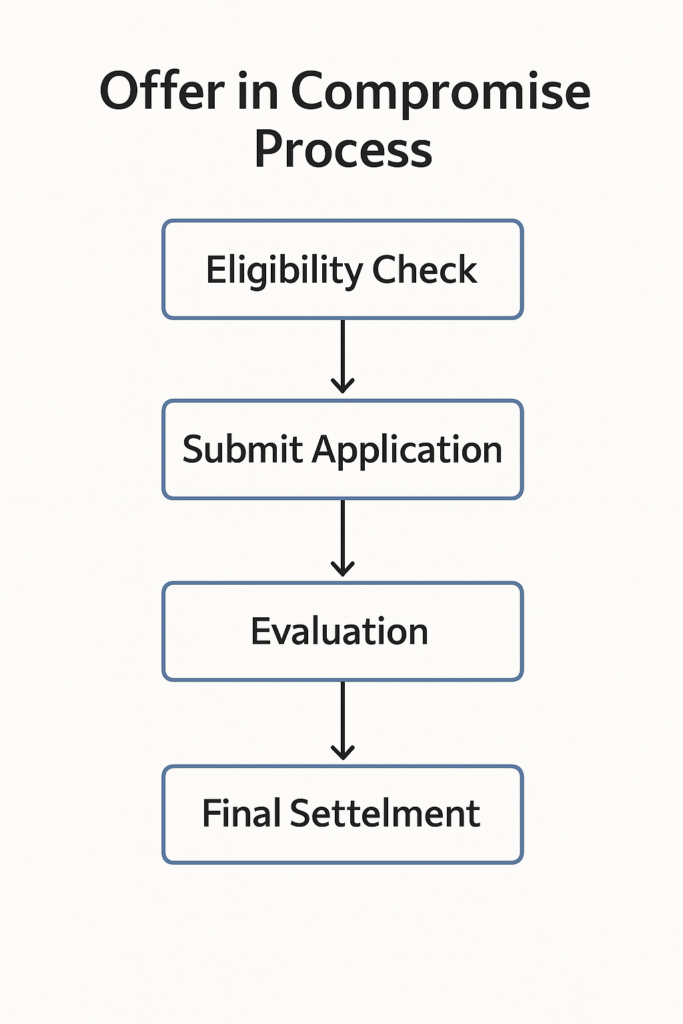

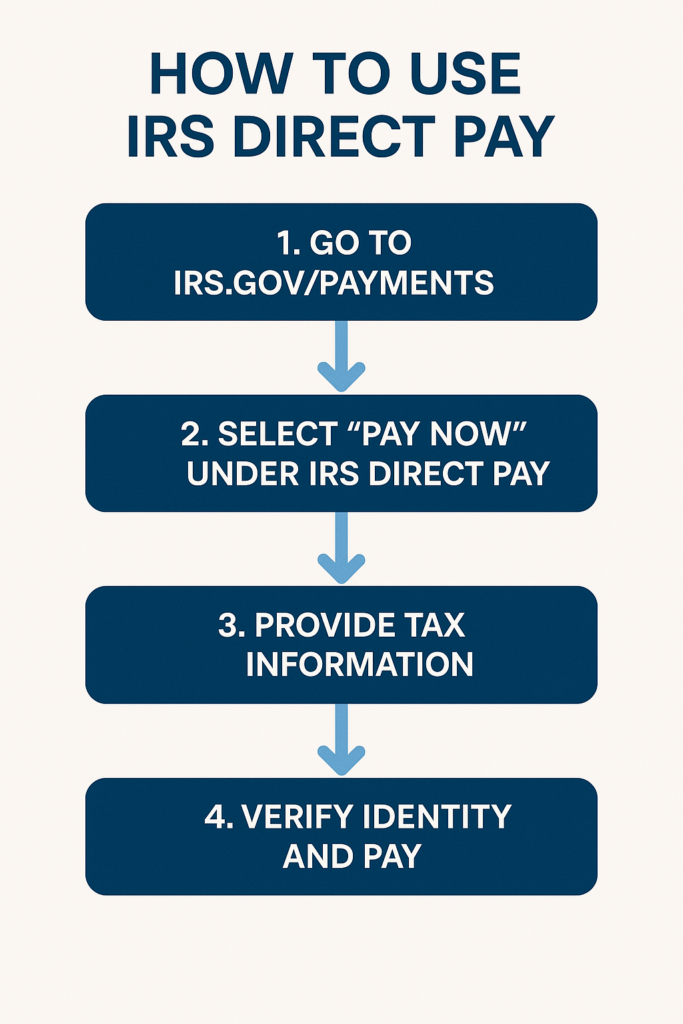

✅ Owe taxes? Set up an IRS payment plan to avoid penalties.

🔗 Learn more: Tax Filing Deadlines & Extensions

6. Check Your IRS Refund Status

After filing, track your refund using the IRS “Where’s My Refund?” Tool.

🔗 Related: How to Check Your IRS Refund Status

Final Thoughts

Filing your taxes for the first time is easy if you follow the right steps. Gather your documents, claim all eligible tax credits, and file before the deadline to avoid penalties.

🚀 Next Steps:

- Choose a free or affordable tax filing option.

- Make sure you have all necessary documents.

- File on time to avoid late fees.

🔗 Need more guidance? Visit our Tax Filing Shortcuts Guide.